RetirementMgmt.com provides nearly all of the information, in one place, that you'll need to know about retirement.

Manage your retirement or you will be wasting the best years of your life!

|

Retirement for most people ranks among the top life-changing events. However, it generally ranks as one of the most misunderstood and poorly planned events. It seems that nearly everyone can’t wait for retirement – that period in life when “one can do whatever one wants to do whenever they want to do it.” Retirement is often referred to as an endless vacation. This is an over-simplified and inaccurate image that, for those who are ill-prepared, results in unmet expectations, disappointment and boredom. For others who are seeking maximum contentment, fulfillment and enjoyment, one needs to treat retirement with the same preparation, planning and continuous assessment/readjustment as one does in the management of their career or other life-changing events.

This website (RetirementMgmt.com) is written from the perspective of a retiree who has and is learning as he goes, having made several good and several bad decisions along the way. I am not an investment adviser, although I’ve conferred with many of them, nor am I an expert in any one of the areas that this website covers. However, as an engineer, technologist and mid-level manager (with over 30 years of management and scientific analysis experience), I have attempted to objectively study retirement and develop a series of explanations, conclusions and recommendations.

This material/information and the rules-of-thumb presented here are most relevant to middle- and upper-income retirees or soon-to-be retirees, but much of it is universally applicable. It covers the 3–5-year period prior to retirement through the first 5-10 years of actual retirement. The information is for general information purposes only. It is based on a combination of research and personal experience as well as some input from financial professionals. Please conduct your own research before accepting my recommendations or advice. Also, you may wish to contact an independent financial professional for alternative input and solutions regarding your specific situation.

|

Major Topics

Major topics addressed in this website are ones that were most relevant to my early years of retirement and are probably relevant to your situation as well. The topics are shown on the website's "Contents" page. Subjects are presented in chronological sequence as follows:

| A. |

Retirement Planning |

Covers goal setting, saving for retirement, budgeting and timing. |

| B. |

Retirement Investing |

Describes the various financial instruments used to achieve your contemplated retirement lifestyle, including 401k's, IRA's, annuities, brokerage accounts, CD's and US Treasury securities. |

| C. |

Retirement Expenses |

Provides perspective on the changes in expenses that you'll experience in retirement. These include taxes, housing, debt, healthcare and insurance. |

| D. |

Retirement Income |

Provides perspective on the changes in expenses that you'll experience in retirement. These include taxes, housing, debt, healthcare and insurance. |

| E. |

Retirement Living |

Addresses retirement location/environment, second home ownership/residency, second career, and vacation/travel. |

| F. |

Estate Planning |

Provides information on how to protect your assets from the IRS through wills, trusts and life insurance. |

Background

According to the Center for Democracy & Technology "The Internet and new technologies give individuals the ability to publish and receive information, participate in political processes and share knowledge. User choice and control, which allow individuals to decide what to say, publish and access online, are essential part of protecting free expression rights."

Retirement is a commencement for the adventure of a lifetime. It is not the end but a new beginning full of excitement and joyful experiences. You are no longer shackled by the demands of an employer or timetable that dictates when you sleep, when you eat, when you have free time. You earned it and paid the price, now it’s your time to be free and pursue any avenue or experience that brings you satisfaction. Just go for it and live your life to the fullest!

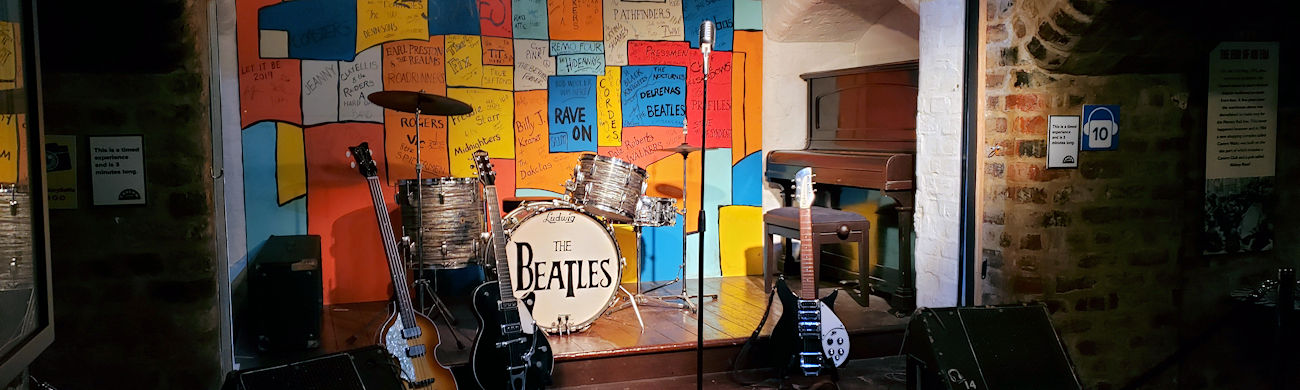

(Pictured above are some of the many places that I've visited in retirement.)